Photo-video nerds apparently got super excited about Nikon’s RED acqusition. Theories run wild that Nikon cameras will feature RED’s global shutter, Sony is screwed this way, Canon is screwed that way. They all revolve around the idea that Nikon will now have access to key technologies and as such will close the gap then overtake Sony and Canon. But I don’t think this decision has much to do with technology. The Nikon Z9 is at minimum on-par with the best cameras today, and the Z8 dominated camera sales in its segment. Yes, video-AF might be somewhat behind Sony, but not that behind that would justify a risky market move, like buying and trying to integrate a culturally very different company. Plus how is RED about autofocus anyway?

| Sony Z-V1F creator camera | $500 |

| Sony Z-V1 creator camera | $750 |

| Sony A6700 enthusiastic camera | $1,500 |

| Sony A7 IV high-end amateur / general purpose professional camera | $2,500 |

| Sony A9 III sports camera | $6,000 |

| Sony A1 sports / studio / shoot-everything professional camera | $6,500 |

| Sony FX6 full frame cinema camera | $6,000 |

| Sony FX9 full frame cinema camera | $11,000 |

| Sony Burano full frame cinema camera | $25,000 |

| Sony Venice 2 full frame cinema camera | $58,000 |

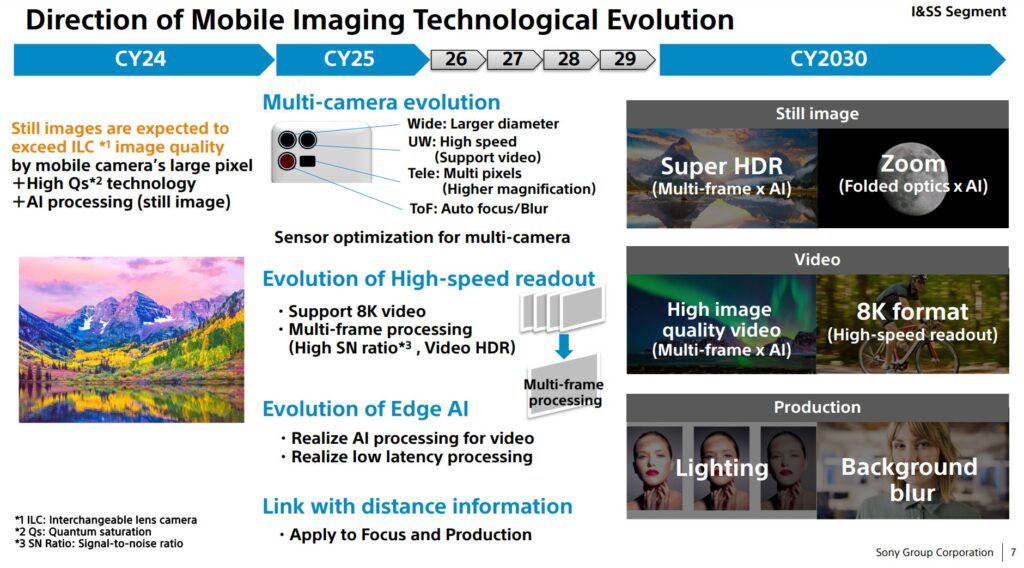

I believe the reasons are more straightforward, it’s just we photo- and camera nerds are in denial when it comes to one hard reality: smartphones pose an existential threat to cameras with no ceiling when it comes to market segment. Full frame cameras, even larger formats might be at risk on the long run. Sony openly admitted in a 2022 presentation that it expects smartphone photography to surpass the image quality of ILC cameras in 3-4 years. Yes, including full frame. This comes from the workshop that develops the best imaging sensors today. It is crystal clear from the product launch trends of the past year that after compact cameras APS-C is next to die thanks to smartphones. Canon and Nikon both focus on full frame, hoping that they have a couple more years before smartphones eat up that market segment too.

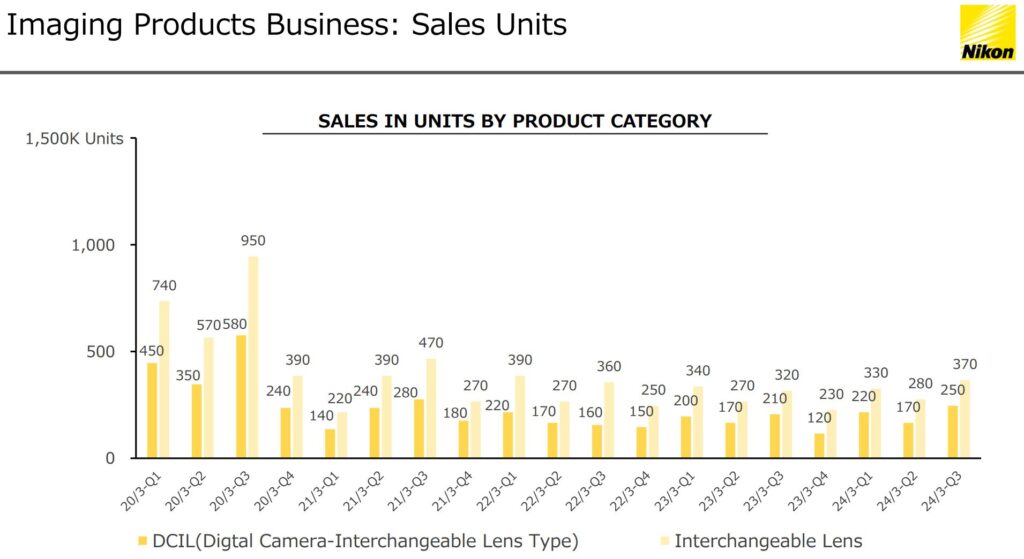

Fujifilm did create a temporary niche with its hipster cameras – sort of Leica for the common man -, and Micro Four Thirds is on life support thanks to the compact wildlife shooters’ package it provides plus the video capabilities of Panasonic, but these might all be transients, and you definitely can’t bet the future of a billion-dollar company on such uncertainties. Have a look at the next chart, which is from Nikon’s quarterly reports. They dropped two of their best bombs on the market (Z9, Z8), have an extremely competitive lineup, yet they are stagnating.

So how does RED come into the picture? Nikon is aware that the market is compressing towards the higher end. The former entry-level market (think Canon Rebels, and Nikon D3xxxx-5xxxx series cameras) is completely lost, and the mid-market (Z5, Z6) is the next to go extinct. They clearly articulated that they focus on the higher end of the market, where there’s still some breathing space left. We camera nerds think Nikon Z9 and Sony A1 as high-end, but in reality, cine-cameras and cine-lenses command prices in a different league and likely have a hefty margin compared to the consumer segment. If you crack open any of the cine cameras, you’ll find that the most expensive hardware components – image sensor, image processing units -, and the most sophisticated software components – the imaging pipeline – are not so different from a consumer camera after all. Sony’s uber-expensive Venice cine-cam line runs on full-frame EXMOR sensors and accept E-mount lenses. Do you think Sony would bother using the same marketing jargon for its cine cameras if it was not a derivative (or probably the exact same chip for many cameras) of the consumer-line sensors?

So, again, how does RED come into the picture for Nikon? I believe the camera market might have entered a phase where you can’t survive as a consumer-only brand anymore. Components are too expensive to develop and consumer demand keeps drying up thanks to smartphones. Are you in for the long run? You better have revenue streams from the entire spectrum of the imaging market. It is crystal clear that there’ll be technology shared across Nikon cinema and consumer cameras (let’s stop calling the former RED cameras) but it’s really not about catching up to Sony or the nitty-gritties of technology / management integration. It is about staying alive for Nikon on a shrinking market.